My mini funds are fully funded! | February 2025 Monthly Money Progress Report

It took me a second to figure out why my mini funds were funded so quickly and I realized I had a good month at the restaurant

Disclaimer: Some of the links below may be affiliate links which I will earn a small commission if you click and purchase from them.

👋🏽 Welcome, reader! I’ve been doing this Monthly Money Progress Report on my Instagram to document my debt-free journey since January 2024. In August 2024, I decided to expand more about my journey here on this blog.

HI HI!

Reporting back to my Monthly Money Progress Report 💚

February was an absolute blur. Celebrated my birthday at Medieval Times, the restaurant got insanely busy because food influencers posted their content back to back, and then some personal things happened. So let’s just say it’s been a rollercoaster ride of emotions but quite a memorable month, both good and bad.

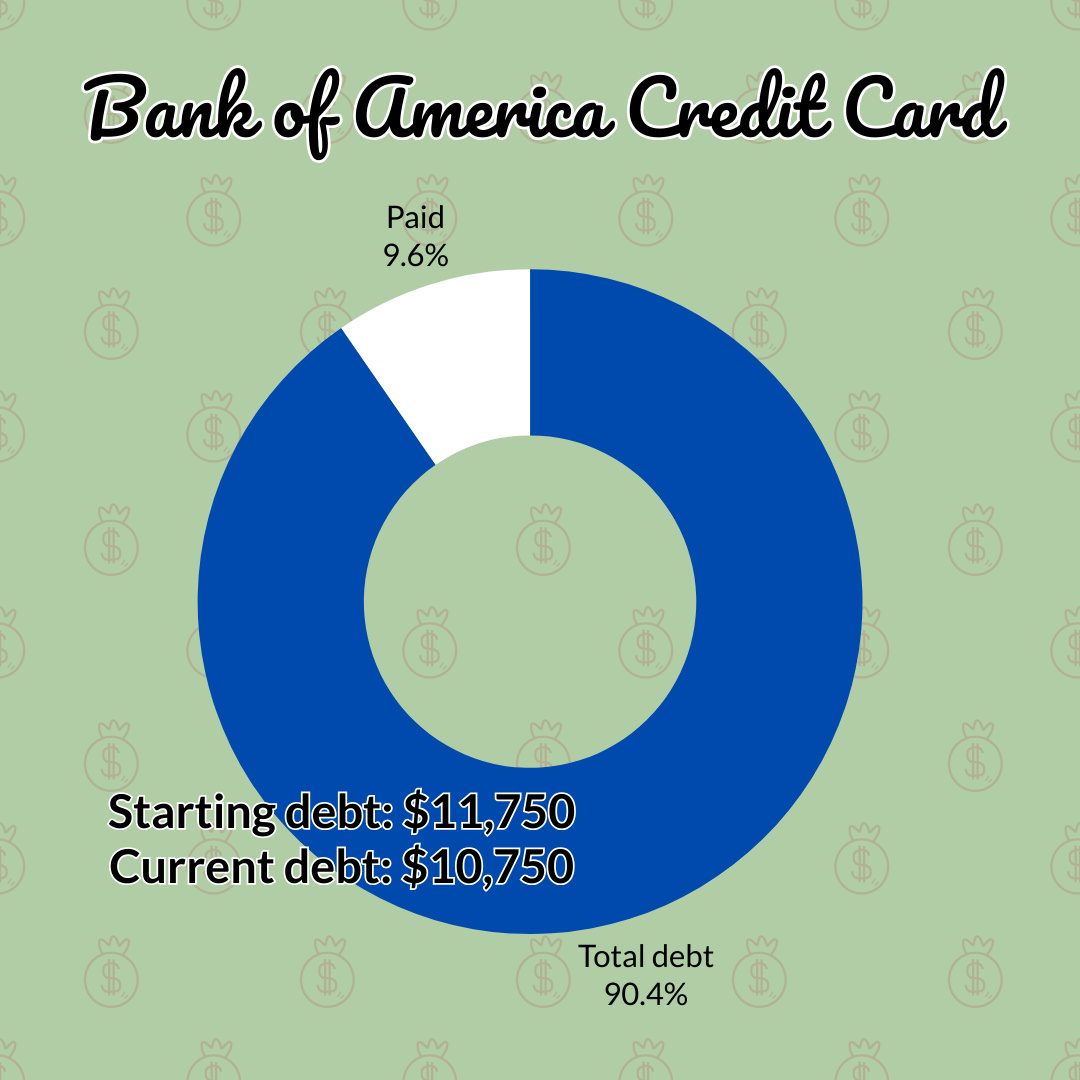

Credit Card Debt

As mentioned in the last Progress Report, I’m putting $250 per paycheck towards my debt. In total, I’m paying off $500 per month to knock down the approx $12,000 debt that I have left at the beginning of this year.

At this rate, I’ll pay off $6,000 off of debt by December. Truthfully, I really want to get rid of ALL of the credit card debt by the end of 2025, but that is a very aggressive/stretch goal of mine.

If I truly discipline myself this year, I think it’s possible. However, I’m just going to stay within the course so that I don’t pressure myself.

At least we’re under $11,000 now, so that’s a win for sure! I can’t wait once we’re right under $10,000 so that I can breathe and be proud of myself that I’ve knocked down a digit.

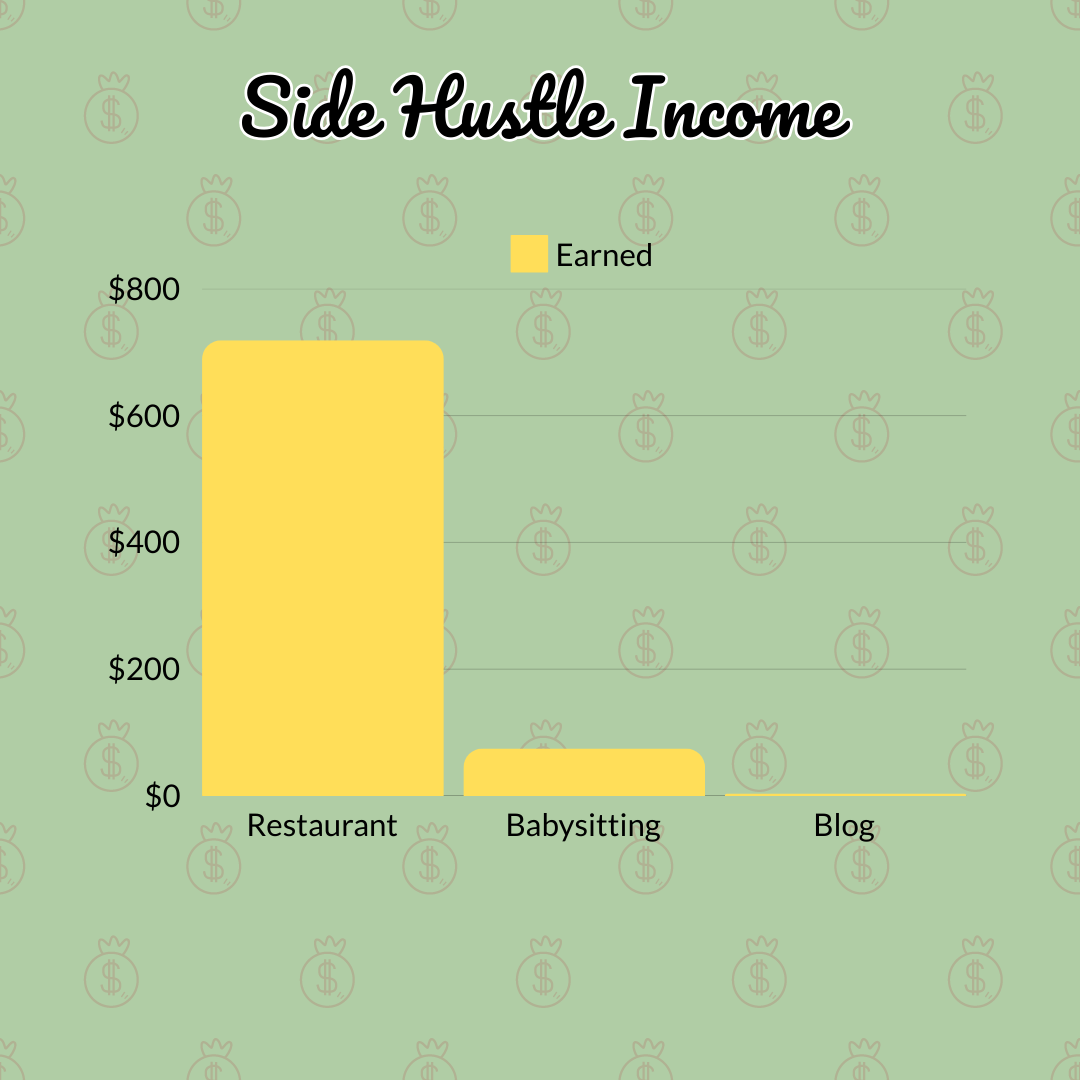

Side Hustle Income

Before we talk about my savings goals, which is usually the next image, I want to switch it up and talk about the side income that I’ve earned this month.

First of all, because of the HUGE viral videos from multiple food influencers of Chicago, @agirlaboutchicago, @super_goode, and @chicityfoodie, we had an INSANE uptick of customers visiting the restaurant.

It literally hasn’t been this crazy busy since we first opened.

Those first few months were definitely growing pains, but over time our team finally found its rhythm. We’ve been killing it with our structured system, better communication, and (almost) flawlessly getting every one of our orders out with no complaints.

With that being said, tips have been REAAAAL NICE these last few weeks. Hence why I received over $700 this month!

Next, I did babysitting one night, and I truthfully wasn’t expecting to get paid because it was my little nephew that I watched over. It was my cousin’s partner’s birthday, so they went out for a birthday dinner and I got to hang out with the little fella for a few hours before putting him down.

It’s been a while since I’ve watched him on my own so I had to be reminded of his nightly routine, but it still blows my mind that the little stinker is walking and babbling some words now 🥹

Finally, my tiny dot of an income from my blog was a beautiful $1 this month 🤣

I did notice a few people canceled their (yearly) subscription to my blog recently 👀👀 But I don’t care since most of them were from friends that I asked to do me a favor when I first started this blog.

I truly don’t expect for all of my friends to stick around in the long run, but I’m grateful that they were open to financially supporting me when I asked them back in 2023.

Still learning and growing, but this year I’m trying to put more attention to this platform instead of social media since it’s been mentally draining to keep up with trends & doing all the editing work.

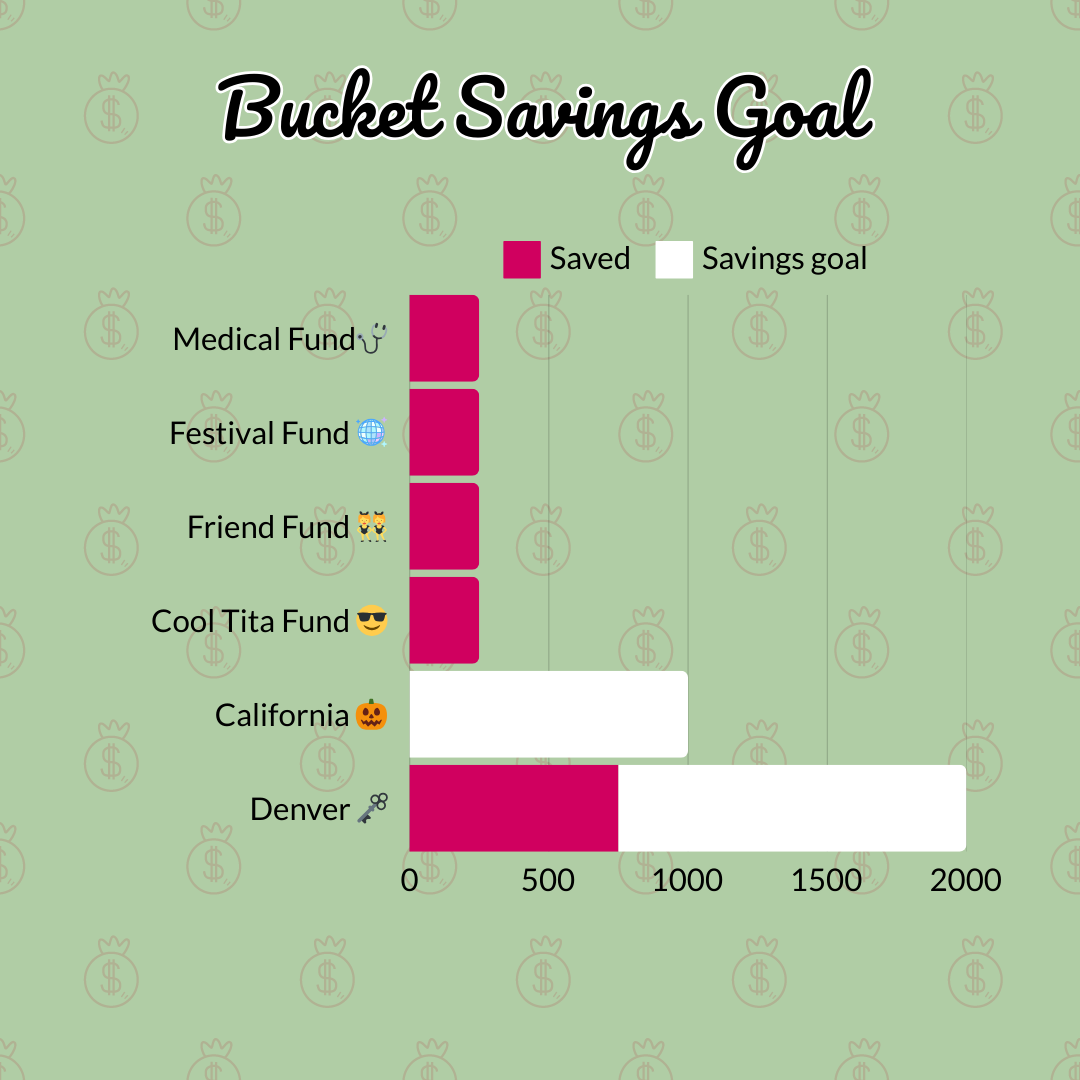

Bucket Savings Goals

Now we’re here for the real BIG WINS 🎉

Fully Funded buckets

- Medical Fund - $250

- Festival Fund - $250

- Friends Fund - $250

- Cool Tita Jem Fund - $250

I have now fully funded these mini buckets!

Took me a second to figure out how and why they were funded so quickly. And then I realized it’s because of all the earnings that I got from working at the restaurant.

My current plan is to transfer all my income from the restaurant to my savings so that I can fund all these buckets and feel secure.

The next savings buckets that I need to fill will take me a while, but I’m pretty much halfway done with Denver and need to work my way to the California one.

Current bucket goals

- Denver - $2000

- California - $1000

Once these trips are fully funded, I think I’m going to aggressively throw the restaurant income into the credit card debt. It only makes sense since I currently don’t have a lot of travel plans besides the occasional Michigan trips for the rest of the year.

I’m also still debating if I should attend any music festivals this year but I think I’m only going to go to one or two this year. Most likely Lollapalooza and Beyond Wonderland, so it all depends on the lineup too.

If all goes well with this plan, then my ambitious goal in paying off ALL my credit card debt this year will come true. Manifesting it ✨💖

No Doomscrolling Challenge

This last image is the progress I made for this money challenge I created for myself this month.

The challenge: If I’m doomscrolling, transfer money over to my savings.

I really have noticed how much I get sucked into social media, and I kick myself for not doing something more productive like reading a book, journaling, or doing an Alo fitness class. So as a punishment for not doing so, I transfer over what I think is a fair amount when I catch myself doing this.

There were plenty of times where I would spend HOURS in bed, scrolling on my phone when I literally had put my book down thinking it would be a few minutes.

I would transfer like $5 or $10, but the max amount that I’ve transferred over was $20.

Sure enough, I saved $120 by the end of February. I might continue this No Doomscrolling Challenge, but I might have to set more rules since this was a test run. I’ll write about this in the future!

Lots of Financial Progress

This has to be one of my most productive and healthy financial months that I’ve ever had. However, I do want to mention that I did start a new hobby… Collecting Pokemon cards.

Since I haven’t been playing any video games lately, and it’s still too cold for Pokemon Go, my love for Pokemon transferred over this side of the fandom. I need to add up how much money I threw in Pokemon cards now, but I’m going to do my best to focus on my goals for my collecting journey: completing the Pokemon Go set and the Detective Pikachu set.

Other than trying to slow down my spending on my new hobby, I’m curious to see how March will look since it’ll be quite busy again. See you next month!

-jemellee

If you're looking to open a new bank account, I highly recommend Ally and they currently have a 3.70% interest rate (as of March 2025) for their savings account.

You can only get this bonus with my link, so open an Ally account soon as this offer ends on 12/31/2025!

Check out my Money Resources page to find all of my recommended products and services that I use on a daily basis to help me with my debt-free journey. Use the buckets feature on Ally Bank to separate your goals in one Savings account or Rocket Money to budget your expenses on a monthly basis.