Pressing the reset button | January 2025 Monthly Money Progress Report

restarting my money progress because i needed a fresh start

Disclaimer: Some of the links below may be affiliate links which I will earn a small commission if you click and purchase from them.

👋🏽 Welcome, reader! I’ve been doing this Monthly Money Progress Report on my Instagram to document my debt-free journey since January 2024. In August 2024, I decided to expand more about my journey here on this blog.

HELLO HELLO!

And we’re back to my Monthly Money Progress Report 💚

I’m pressing the reset button and giving myself a fresh new start with this series. If you haven’t been following me, I do this monthly progress report to hold myself accountable and to document my progress in getting myself out of debt.

I originally had over $20k in credit card debt back in 2023, and some additional debts that I accumulated since then, but I’m now down to the Final Boss of my debts.

Before I left for my trip to NYC over the holidays, I was right under $10,000 and was pretty proud of myself for the progress and the discipline that I had to push myself to get there. However, after my trip, I brought my debts back up to $2,000. AFTER ONLY 2.5 WEEKS STAYING THERE.

This was because I never intended on going back to NYC, but I made the last minute decision to go back to my hometown since my family here in Chicago had made their own holiday plans elsewhere.

Thankfully, I’m not stressing about this small setback because this speedbump was worth healing my homesickness.

Why am I resetting my progress?

I’m hitting the reset button because even though I’ve made so much progress in the last 2 years, my trip back home to NYC allowed me to reset a lot of my friendships, my relationships with some family members, with work, and with my mental health.

To stay with this trend that’s happening in my personal life, I decided to put a reset on tracking my financial progress too. Sometimes all we need is a clean slate to put ourselves in a position to say, “Hey! Let’s start from scratch again.”

So here we are. Back to “zero” and restarting the progress for the new year of 2025.

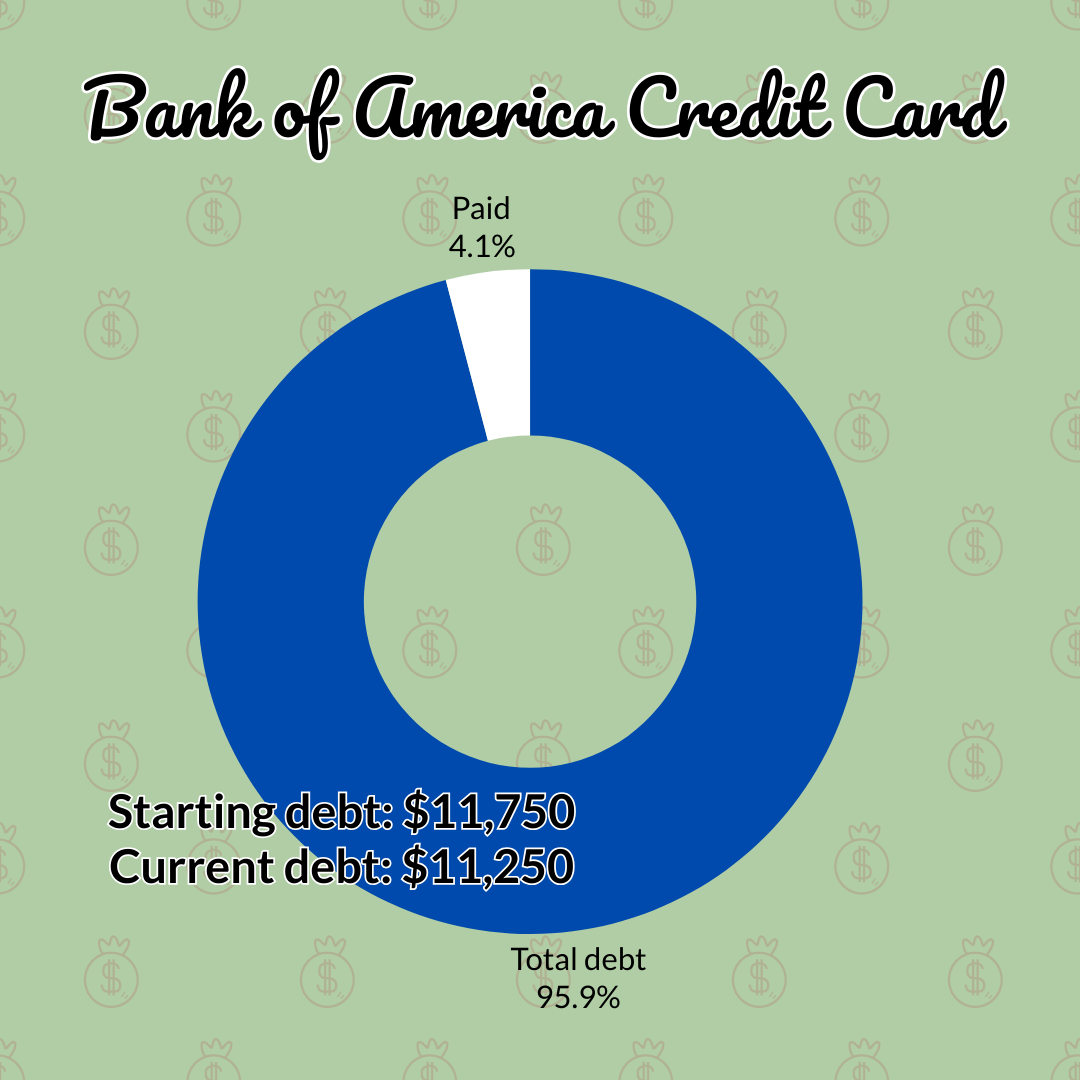

My current credit card debt

Starting debt: $11,750 | Current debt: $11,250

Here’s how I'm handling my credit cards this year:

- Bank of America - Carries all my historical credit card debt

- Chase - day-to-day purchases

- Discover - backup credit card

When I use my Chase credit card, I already have a biweekly budget. I know how much I usually spend on a daily basis, so that money is put aside in my checking account and then I pay it off every week or so.

As I mentioned earlier, I racked up $2,000 when I was in NYC. All of those NYC purchases were in my Chase credit card, so I ended up doing a quick balance transfer to my Bank of America credit card.

I decided that I didn’t want to deal with paying off 2 large balances at the same time, plus I would have 0% interest on that balance for 12 months, so at least it will help pause on the interest

Right now, the plan is to pay off $500 every month, so I take $250 from every paycheck towards the debt.

I want to ambitiously pay off $1k per month this year, but realistically, $500 per month makes sense for me right now.

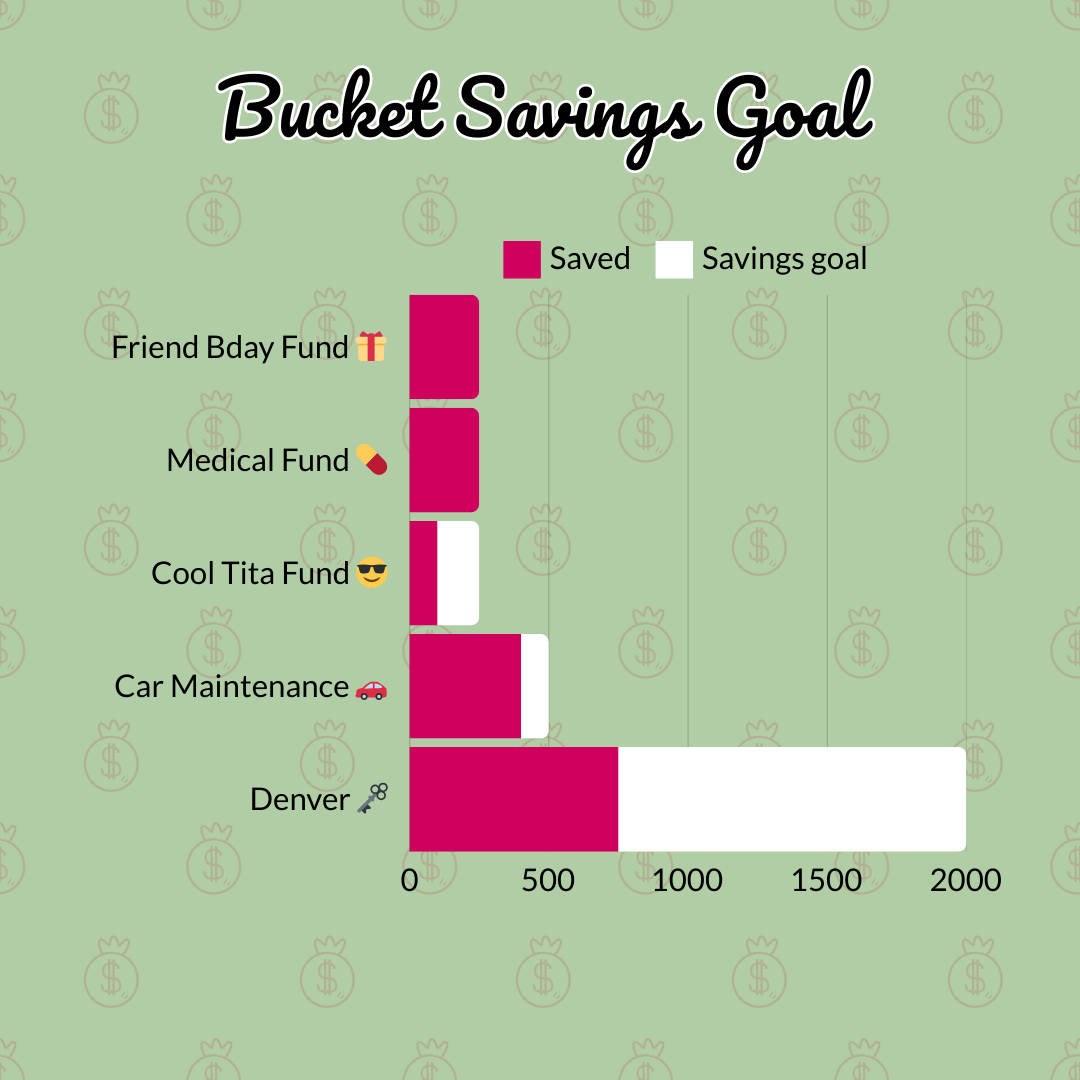

Savings goals

- Friend’s birthday fund - $250 ✅

- Medical fund - $250 ✅

- Tita Jem fund - $100 / $250

- Car maintenance fund - $400 / $500

- Denver - $750 / $2k

This year I came up with a bunch of mini funds that I wanted to have in my Ally savings account.

Because I was so grateful for some of my friends and I’m finally feeling a bit more secure with my finances, I decided to make a Friend Birthday fund for my friends. Being long distance is rough, and I don’t talk to them often. So I want to make an effort to at least send them a gift when their birthday comes up.

I know $250 seems a lot to spoil them, but I have a couple of friends that were born in January, so that’s why I decided on this amount just in case.

This is the year I FINALLY have good health insurance so I started to build this Medical fund. This fund is for when I need to make payments like a co-pay or receiving a bill after my insurance covers what they could. Hopefully, my bills aren’t crazy high, but I figured let’s start small for now with $250.

The Tita Jem fund is another new one that’s similar to my Friend Birthday fund. Now that I’m feeling a bit more secure with my finances, I want to spoil all the little brats that are in my life. Whether it’s for their birthday, or just a random gift that I think they should have, I want to be able to have the money to cover that without any guilt that I couldn’t give them a gift.

Finally, I have my Car Maintenance fund and my upcoming trip fund to Denver this summer. I actually don’t have a lot of travel plans this year. But unfortunately, what happened last month doesn’t exactly make me feel excited to fly at the moment. However, it just means that I’ll probably do more road trips around the Midwest if I’m feeling the urge to get out of Chicago.

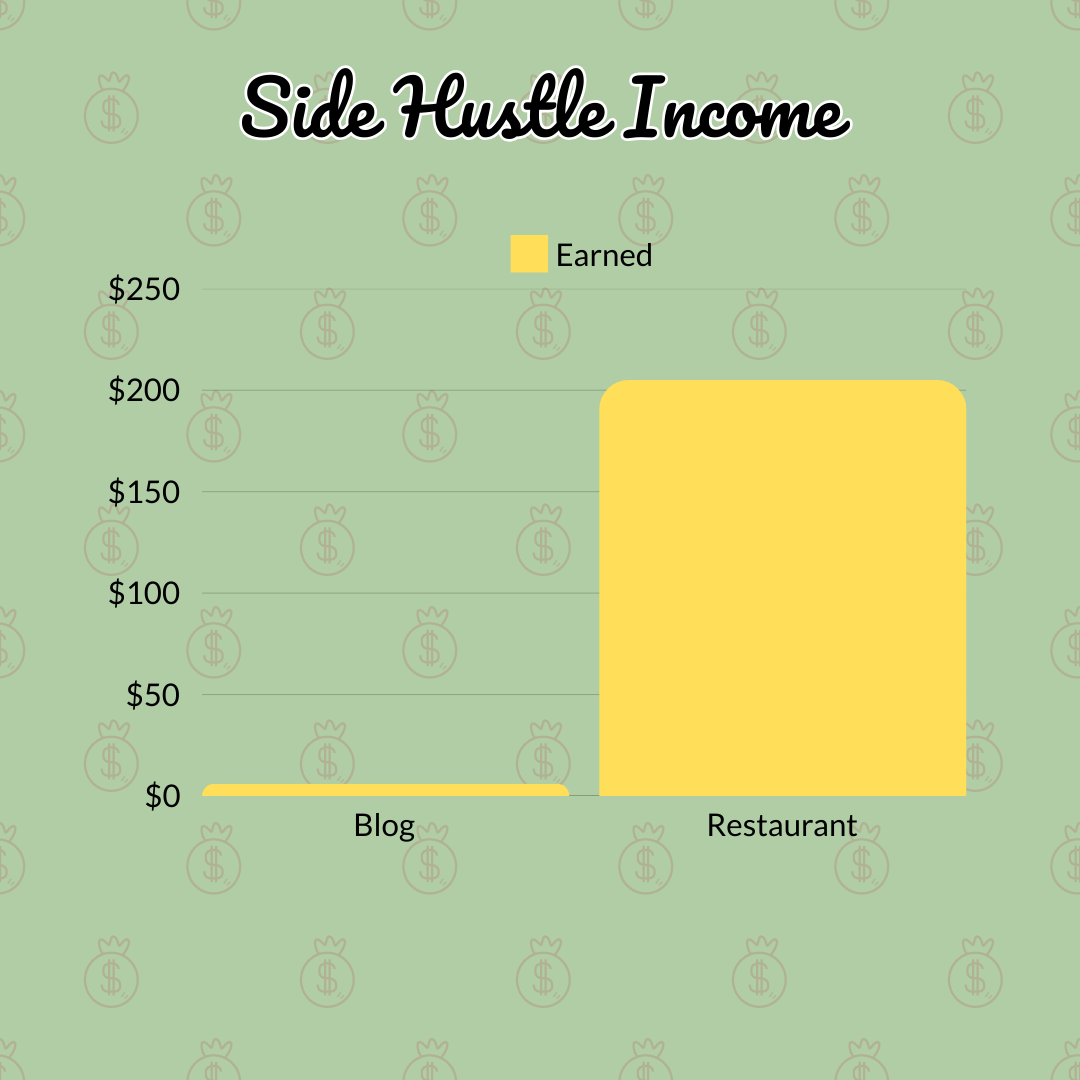

Side hustle income

- Restaurant - $205

- Blog - $6

Once a week I work at the restaurant, and even though I’m sacrificing my Saturday mornings, the pay off is my friendship with Kathy, my coworker, Ed, and the regulars that we see.

I’m so proud of Kathy and grateful to be part of her little empire. Because of her restaurant, I was able to build new friendships with our regulars and the Filipino community that I didn’t know that I was missing when I moved here.

On a rare occasion, I will babysit every once in a while, but the one stream of income that I totally left out from last year is my blog income.

If you’re reading this, and you’re a paid member, thank you so much for supporting me. When I first started this website, I underestimated how much work I needed to do in order to be consistent and also think of ways to provide valuable content for y’all to stay subscribed.

I’m working on a couple of things behind-the-scenes, and I hope to turn things around this year for my paid subscribers.

In the meantime, the income from the blog varies because between the paid subscribers and some affiliate earnings, it’s literally pennies to maybe $100 max per month. So this year, we'll see how much I will be making with this blog.

I’m excited for my financial progress this year

2023 and 2024 were definitely my growing pains in my financial journey. After reading tons of books for personal finance, allocating my funds with my various bank accounts, and building a good habit of my spendings, I’m feeling extra confident that I may be able to pay off my credit card debt early.

But in the meantime, I’m going to keep up with my current pay off plan and throw in any extra money to the debt if that ever happens throughout the year.

Paying off this debt was a huge mountain to climb. But I think the hard part is over, and now all I need to do is stay on the course, and I can breathe a bit easier now that I have things under control.

I hope y’all will be there for me when I make that final payment 💚

-jemellee

If you're looking to open a new bank account, I highly recommend Ally and they currently have a 4.20% interest rate (as of Feb 2025) for their savings account. (You'll also get a bonus $100 in your account, that's practically free money 😁) You can only get it with my link, so open an Ally account soon as this offer ends on 12/31/2024!

📲 where else to find me 📲YouTube | Instagram | TikTok

Check out my Money Resources page to find all of my recommended products and services that I use on a daily basis to help me with my debt-free journey. Use the buckets feature on Ally Bank to separate your goals in one Savings account or Rocket Money to budget your expenses on a monthly basis.