somehow i paid off $1000 off my debt | March 2025 Monthly Money Progress Report

Don't talk to me. This month was a huge blur. (For an understandable reason)

Disclaimer: Some of the links below may be affiliate links which I will earn a small commission if you click and purchase from them.

Welcome, reader! I’ve been doing this Monthly Money Progress Report on my Instagram to document my debt-free journey since January 2024. In August 2024, I decided to expand more about my journey on my blog.

I want to be perfectly transparent for this month’s report.

Everything was a total blur.

Towards the end of February and entering March, I was still grieving for my grandpa who passed away, so I didn’t take care of myself as much as I would like.

I didn't want to do grocery shopping, so I mostly ordered food deliveries. Sometimes I wouldn’t eat which I think is one of the side effects I’m experiencing with my new ADHD medication. I stopped doing my evening Pilates, so I feel out of shape again.

I was in sloth and autopilot mode for all of March.

Work. (Barely) eat. Doomscroll on my phone or browse on YouTube. Maybe cry. Sleep. Repeat.

Whenever I travel, I need to give myself at least a day to mentally prepare before I leave for my destination and then I need another day to recover when I return. However, since this trip was for a funeral, I basically gave myself a week to mentally and emotionally prepare and another whole week to recover when I got back home.

Hence, the whole month of March was a big blur to me.

In the midst of grieving, I have mentioned last month that I have started to get into the hobby of collecting and hunting Pokemon cards. I think in a way, it became my coping mechanism for a bit of joy in my life while I’m dealing with all these heavy emotions.

Hunting for cards meant I'm a few cards closer to completing a set. I get a dopamine rush whenever I open new packs. And once I get home, I get to be in Zen mode when I organize my newly purchased cards into my binders. It’s become my new therapeutic ritual before I go to bed every Saturday.

However, after weeks of intensely and hyperfocusing on this hobby, I’ve realized that my poor spending habits have reemerged. I have mindlessly swiped my credit card and didn't flinch at the nearly triple digit total amount on digital screen. It’s quite bad 🫣

This is where I need to snap out of this coping mechanism trance and get back into reality.

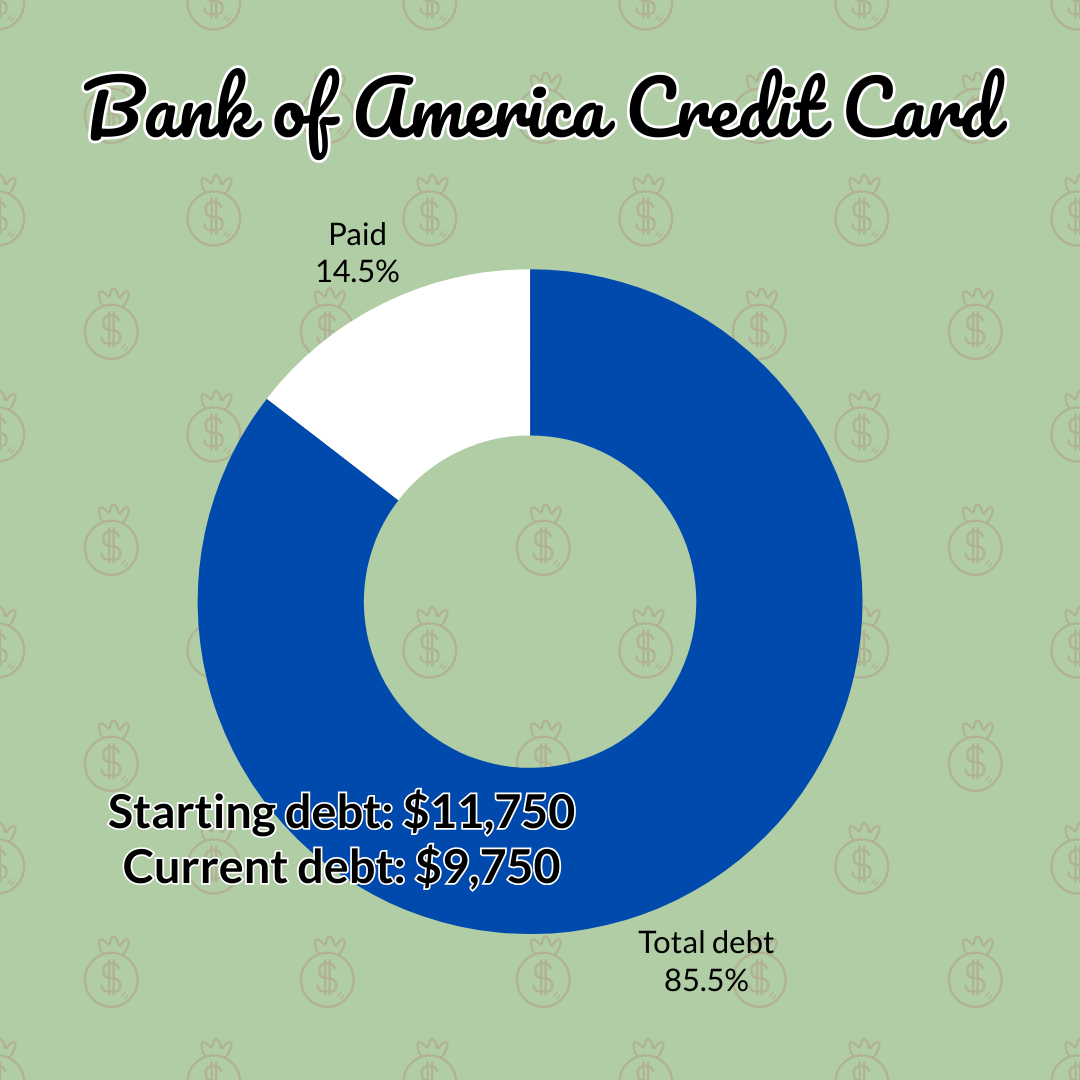

Credit Card Debt

The silver lining of my grandpa’s passing is that inheritance is now being distributed. Since my father is aware of my current debt situation, he plans on providing me some extra financial assistance.

I did receive $1,000 from my dad already, but I put half towards the debt and the other half to medical bills that I didn’t expect to receive earlier in the month. (That will be a rant for another day).

I’m a bit ashamed that I was recklessly spending my money on Pokemon cards and food deliveries. But I did the bare minimum to function as a human being and thankfully I was still able to cover these expenses with the money that I had left untouched in my account. Not exactly part of my plan, but I made it work.

My scheduled payments of $250 per paycheck still took place, so I was able to knock down $1,000 off the Bank of America card instead of the usual $500.

I’m finally at under $10,000 of credit card debt! We’re so close to the end now.

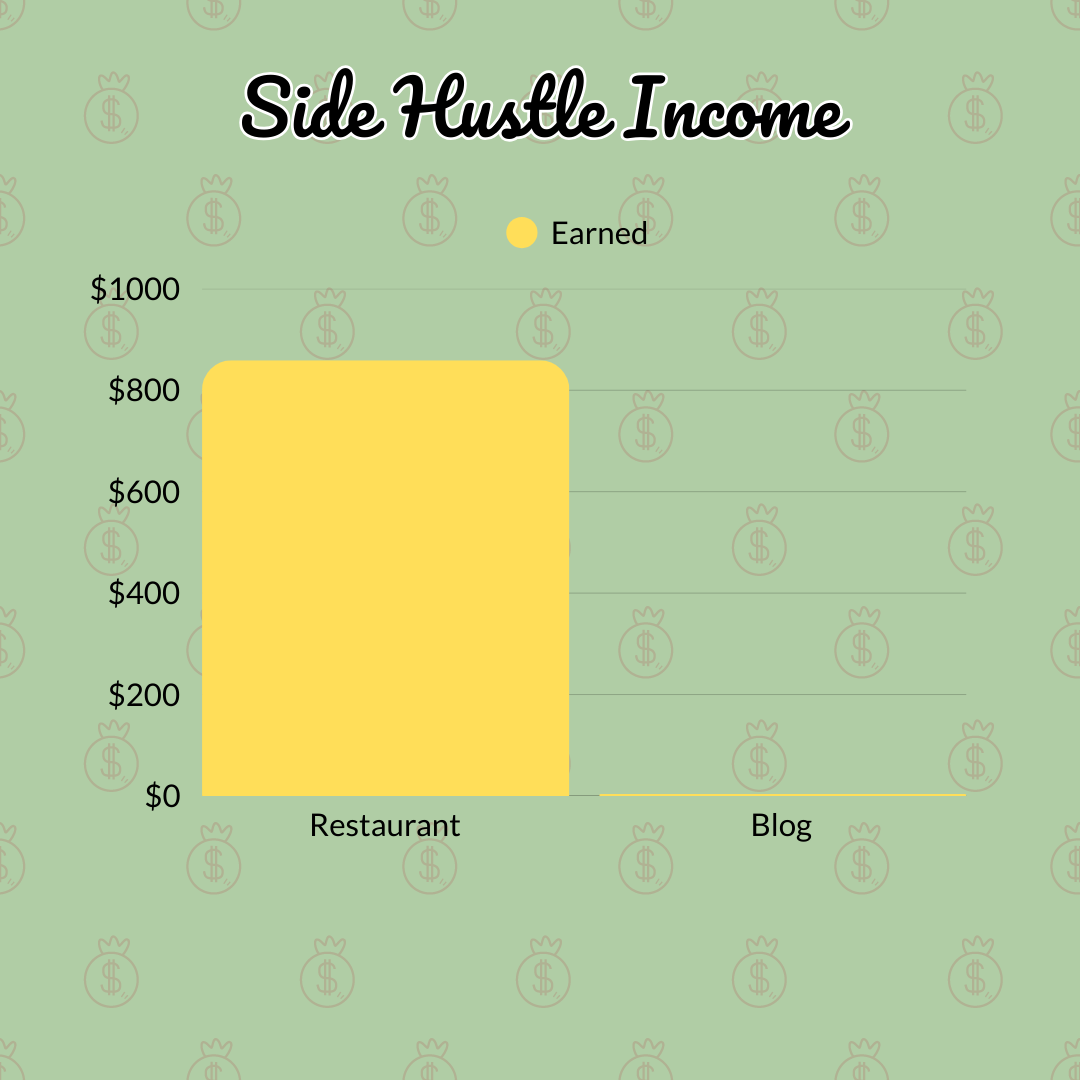

Side Hustle Income

The restaurant has been consistently busy in the last couple of weeks. This also meant our tips have increased as well.

Even though it’s just another couple of hundred dollars in my pocket, working at the restaurant is a nice break from office life during the week.

Also my babysitting days have slowed down, so I’m doing everything I can to improve my marketing skills and search for other side gig opportunities.

I've also created a new nerd blog, Pixelated Reviews, so I can be a bit more unhinged with my fangirl posts. It's still bare bones, but I am looking forward to growing this website because I love to talk and share anything that's pop culture or anything that's viral on the internet.

If you're interested about my Pokemon card hobby, I'll share be posting more about it on that blog soon!

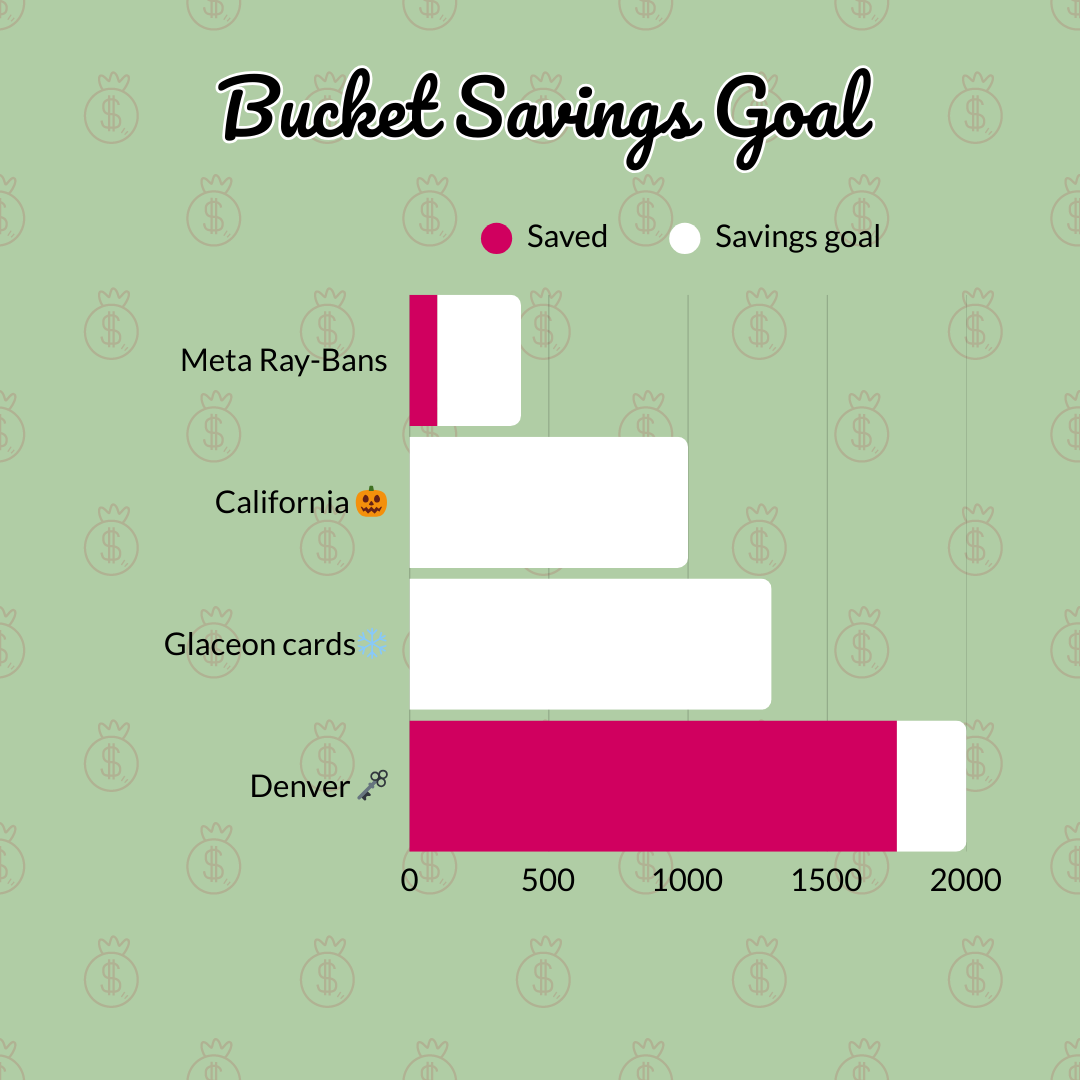

Bucket Savings Goals

With my current savings goals, I’m almost done funding my Denver trip in July, so my next small goal is to purchase the Meta Ray-Bans. I’ve been eyeing these glasses for over a year now, and I think it’s time to finally invest in them. I haven't been filming as much as I used to since last Fall, so I figured capturing my POV may be the easier route.)

While they’re quite a hefty price, I wish the money I had spent on Pokemon cards should've gone to that fund so that way I could’ve purchased the glasses sooner.

But alas, I shall face my financial consequences, look at my current expenses and adjust my budget accordingly. I’m hoping by the end of this month or in May, I shall have new tech to play around with for the rest of the year.

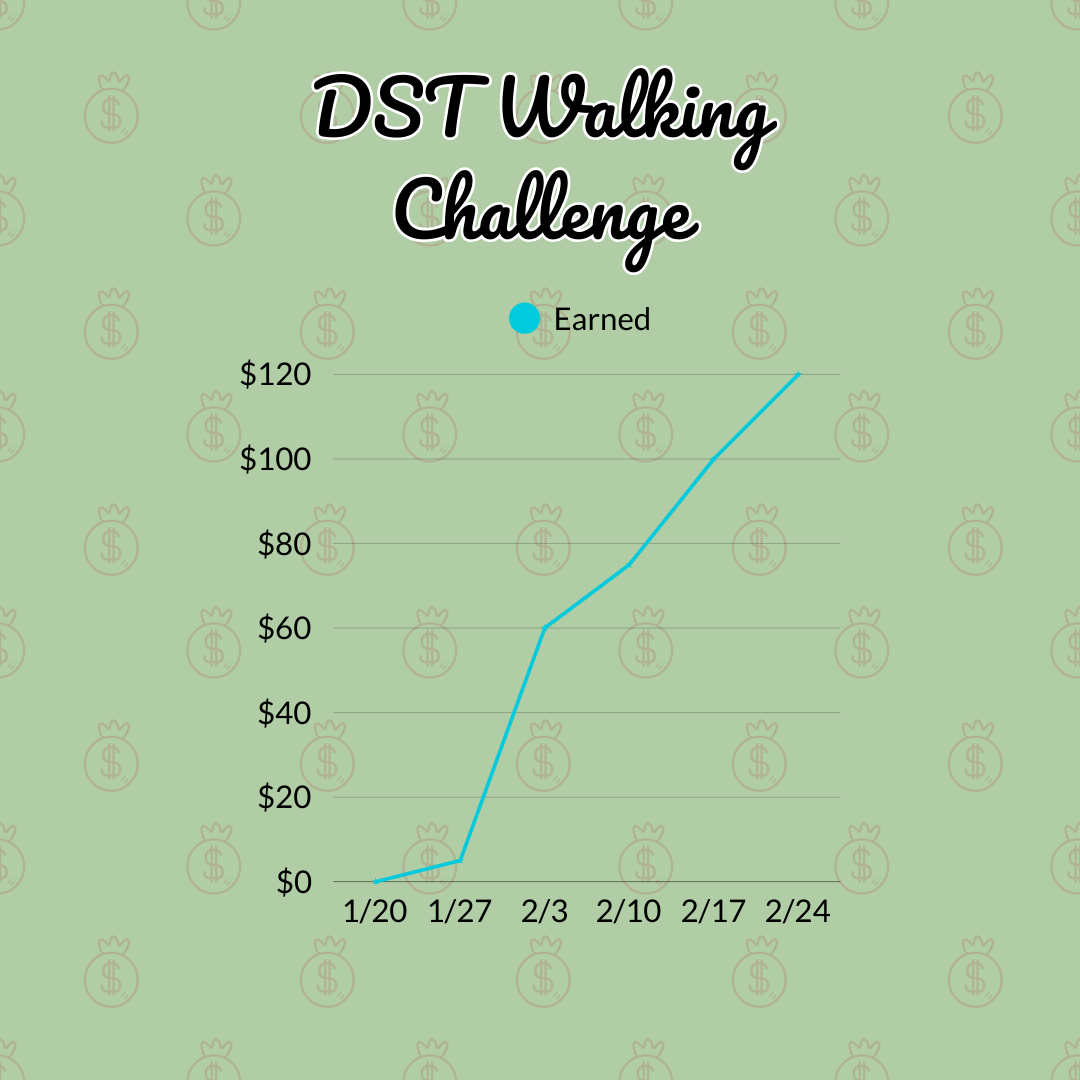

I also did a quick money savings challenge, which was created by @MillenialInDebt so I managed to save up to $125. That’s definitely a win!

we're making progress, y'all!

My financial plan for April

With the stock market crashing, the new tariffs are being implemented, and looking to diversify my streams of income, I’m doing everything I can to reallocate my funds and my savings transfers.

Some advice I’ve been hearing during this time of crisis: increase your emergency fund, start cutting back more, and don’t sell your investments.

Even though I am financially on track with my current plan to be debt-free by early next year, I will be taking some extra time look things over and make some adjustments again.

I don't like that I need change my plans, but I know it’s going to be a huge necessity.

Despite things keep constantly changing every few months, I have faith in myself (and in humanity). I truly hope that we're all going to be just fine in the end ❤️🩹

-jemellee

Take a look at my Money Resources page to find all of my recommended products and services that I use on a daily basis to help me with my debt-free journey.

I’m currently using the buckets feature on Ally Bank to separate my funds in one Savings account (Interest rate at 3.70% interest as of March 2025) and using Rocket Money to budget my expenses accordingly on a monthly basis.