Starting everything over | October 2024 Monthly Money Progress Report

But because I want to get small wins, every time I save $1000, I’ll use it to pay off the debt.

Disclaimer: Some of the links below may be affiliate links which I will earn a small commission if you click and purchase from them.

👋🏽 Welcome, reader! I’ve been doing this Monthly Money Progress Report on my Instagram to document my debt-free journey since January 2024. In August 2024, I decided to expand more about my journey on my blog. Here’s for the month of October!

OH, SO MUCH HAS CHANGED since my last Money Monthly Progress Report.

Without going into too much detail, I made a sacrificial decision to use my emergency fund (that I had just recently funded 🥲) to pay the full amount of my personal loan back. And because of this decision, I want to use this opportunity to revamp my budgeting plan and debt repayment strategy.

I’m giving myself a whole new fresh start in my debt-free journey.

Here’s what I’m doing now:

- I’m no longer doing the snowball method (see below)

- The 50/30/20 rule has been adjusted again (see below)

- All side hustle income goes directly to my emergency fund until it’s funded again

☃️ No longer doing the snowball method

If you have been following my Monthly Money Progress Report on Instagram, I was paying back my Google Pixel 8 Pro, some expensive art, my personal loan, and the huge credit card debt this year. While also saving up for two big trips: a friend’s wedding and my Olympic trip to Paris.

The start of 2024 looked like this:

- Loans/Debt - approx $21,000

- Savings goals - approx $6,000

I am very proud of myself for all the budgeting and strategic planning that I did in 2023 because I successfully paid off the phone, the art, the personal loan, and funded my two trips by the end of October 2024 🥳

Full disclosure: I did have some help from friends and family that threw in a few hundred dollars when I was hit with unexpected expenses or just wanted to help out from the kindness of their heart (thank you so much, you know who you are! 🥹) So I’m really grateful that the extra cash helped me with my progress.

The only thing I have right now is my huge credit card debt that I need to tackle, and that’s it. 🥳🎉

I might have a few trips that I want to do for 2025, but that’s currently on the back burner for now.

Because I’m not doing the snowball method anymore this changes how I’m splitting up my paycheck, my minimum payment, and savings plan.

The snowball method is really great for people who have ADHD, like myself, who have multiple loans and need a plan. Having those small wins really help boost your personal morale and it gives you some milestones in your progress.

Even if you don't have ADHD, I would still recommend it to anyone struggling to figuring out a plan.

🏦 Updated the percentage of my paycheck

A few months ago, I talked about how I’m doing the 50/30/20 rule as my budgeting strategy and how I use three accounts, 2 checkings and 1 savings to help distribute those splits.

It worked GREAT when I was doing my snowball method because it disciplined me to not touch certain accounts and let the automations do the work. Because of these new healthy money habits, here’s my new split:

25% - Bank of America checking account

25% - Ally savings account (more or less)

50% - Ally checking account

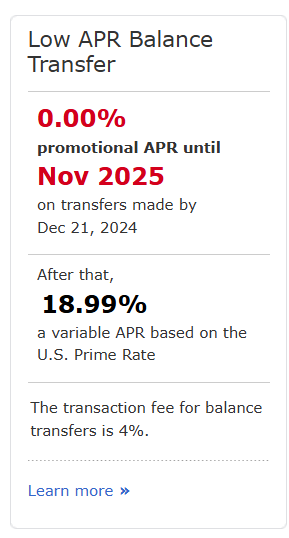

The reason why I did this is because all the credit card debt that I had was in my Discover credit card. And because the 12 months of 0% interest period was ending in October, I did another balance transfer over to my Bank of America credit card for another 12 months of 0% interest.

Since I was using my BofA checking account as my main account for my daily expenses, I’m now using it as the account that receives and pays off my credit card. So that 25% direct deposit is now the amount that I use to pay off the BofA credit card.

And because the rest of the money goes to my Ally checking account, I distribute it as needed to my savings account.

Side story (it’s relevant) - When I transferred over the $12k to my Bank of America card, of course, there’s a balance transfer fee (4%). Which became approximately a total of $12,450 that I now need to pay off.

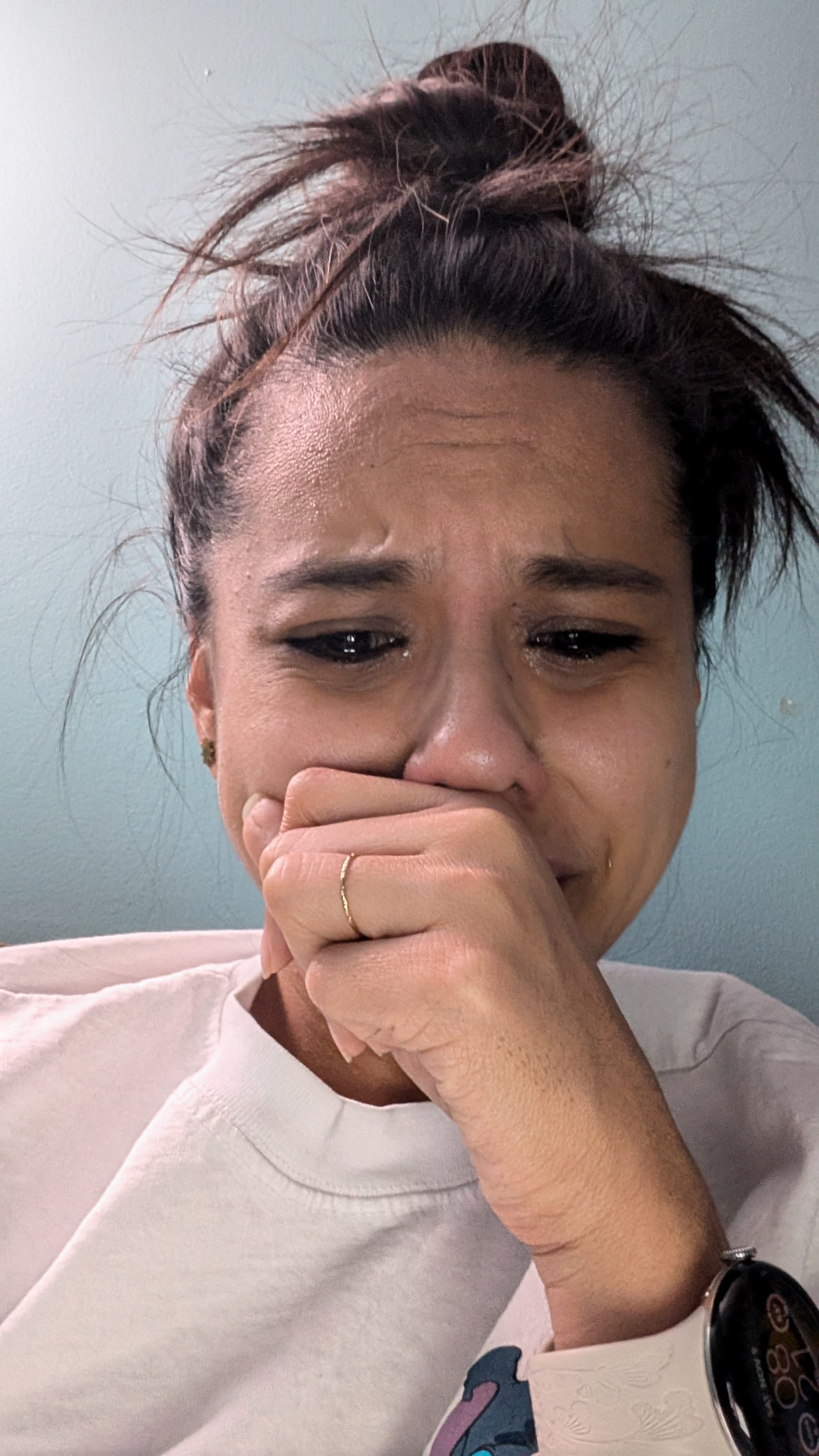

Here comes the mixed feelings of sadness and joy: When Childish Gambino/Donald Glover announced that he was canceling the rest of his tour because of his current health conditions, I was DEVASTATED.

It was heartbreaking to hear because I had yet to see him live and now I lost my opportunity to see him perform all the songs I listened to in college 😭

BUT the plus side of it, it meant that I was getting a refund back to my Bank of America card. I bought 3 tickets for myself, my cousin, and my friend, so the total was about $600+.

So the refund ended up paying my balance transfer fee and a little bit of my debt that I had just transferred over.

The LIVE YOUR LIFE Jem was sad. But the BROKE ASS Jem was THRILLED.

As of November 2024, I am right under $12,000 of debt that I owe 🎉

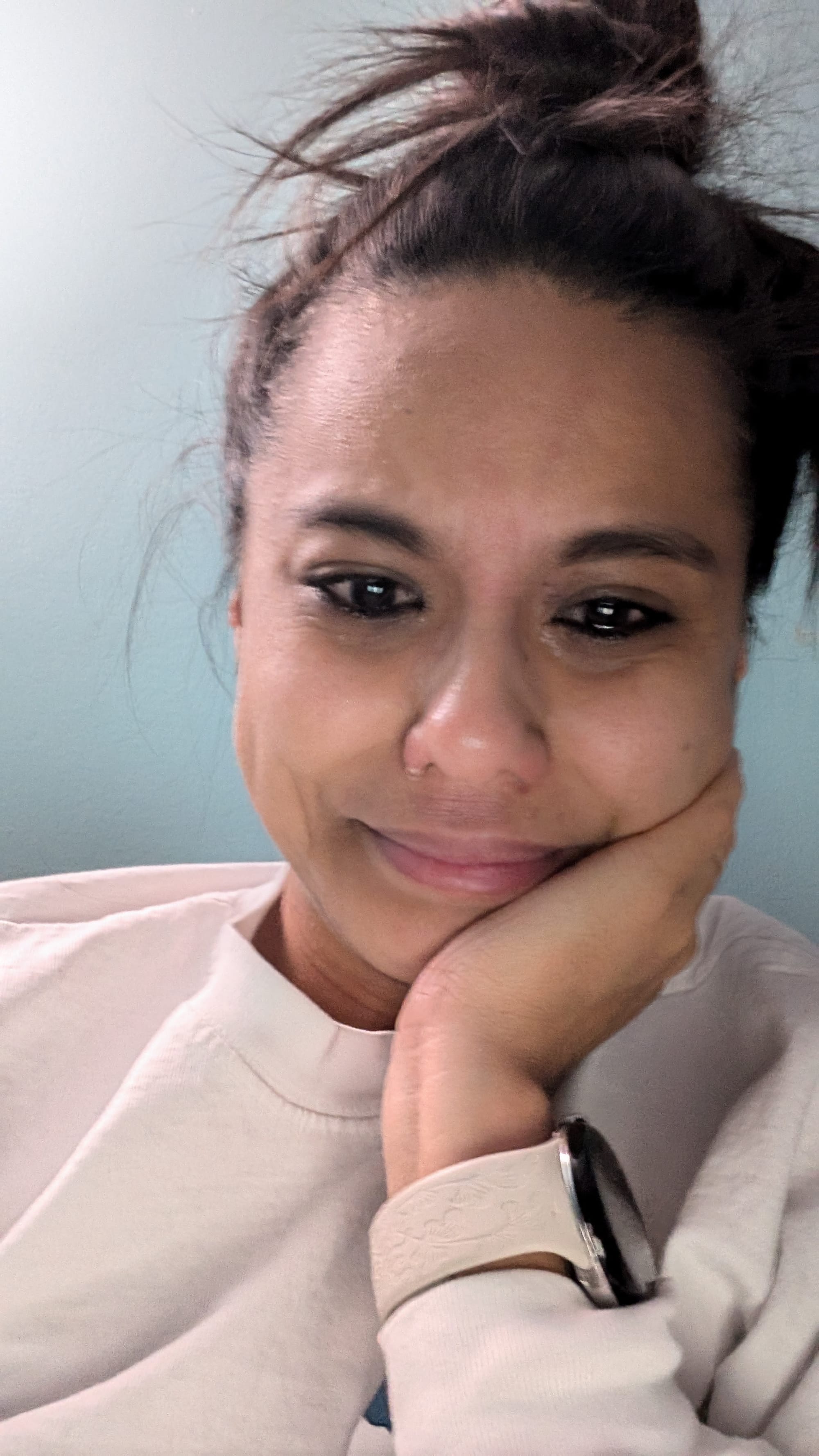

❤️🩹How I feel about my finances now

These last two years have been extremely healing for me because I’m FINALLY sticking to a financial plan without a drastic life event like moving unexpectedly or losing a job.

I’m literally crying as I type out these last words because it just hit me that I am capable of achieving these financial goals.

i'm very proud of myself 🥹

Life may not have been kind to me in all aspects of life in the past, but I am ecstatic to see all of this debt to be gone soon which has been burdening me for nearly a decade.

When I was in therapy, one the main topics my therapist and I was talking about was money. Money was a HUGE stressor of my life.

Back then, my money was controlling me.

Now I’m controlling my money.

Which gives me more confidence that I finally have control of my life too.

It’s been a journey for sure, but I’m glad that I’m in a place where I can pay for a friend’s birthday drink or give a $50 donation without it feeling like a major hit to my budget.

Whew, November’s progress report can’t beat this one 😂 But who knows what will happen this month or by the end of the year!

Thanks for reading, and I hope this gives anyone some encouragement who is in a similar situation as me ❤️🩹 See you in the next Monthly Money Progress report.

-jemellee

Also if you're looking to open a new bank account, I highly recommend Ally and they currently have a 4.20% interest rate for their savings account. (You'll also get a bonus $100 in your account, that's practically free money!) You can only get it with my link, so open an Ally account soon!

📲 where else to find me 📲

YouTube | Instagram | TikTok

Check out my recommendations page, Amazon shop , or Kit to find any products that I may have mentioned on any of my posts!